Your Working capital cycle formulas images are available in this site. Working capital cycle formulas are a topic that is being searched for and liked by netizens today. You can Find and Download the Working capital cycle formulas files here. Get all free photos and vectors.

If you’re looking for working capital cycle formulas pictures information linked to the working capital cycle formulas interest, you have visit the right blog. Our website always gives you suggestions for seeking the maximum quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

Working Capital Cycle Formulas. Working Capital Current Assets Current Liabilities. A ratio above 1 means current assets exceed liabilities and generally the higher. Current assets Assets converted to cash value within a normal operating cycle Current liabilities. The formula that businesses use to calculate working capital is as follows working capital current assets current liabilities on the other hand to calculate working capital requirement businesses have to follow the below-mentioned formula net working capital requirement inventory accounts receivable accounts payable the formula of.

Assets Liabilities Equity 2 Tys Izobrazhenij Najdeno V Yandeks Kartinkah Small Business Accounting Accounting Bookkeeping Business From pinterest.com

Assets Liabilities Equity 2 Tys Izobrazhenij Najdeno V Yandeks Kartinkah Small Business Accounting Accounting Bookkeeping Business From pinterest.com

The formula that businesses use to calculate working capital is as follows working capital current assets current liabilities on the other hand to calculate working capital requirement businesses have to follow the below-mentioned formula net working capital requirement inventory accounts receivable accounts payable the formula of. As we mentioned before the working capital cycle formula tells you how many days it takes for your business to turn your working capital into cash. This number is how many days the business is out of pocket before receiving full payment and is whats known as a positive cycle. Most often this ratio is calculated at year-end when annual reports are available. Current assets Assets converted to cash value within a normal operating cycle Current liabilities. Working capital is calculated by using the current ratio which is current assets divided by current liabilities.

If the value of ration is lower than 1 then it indicates the negative value of it.

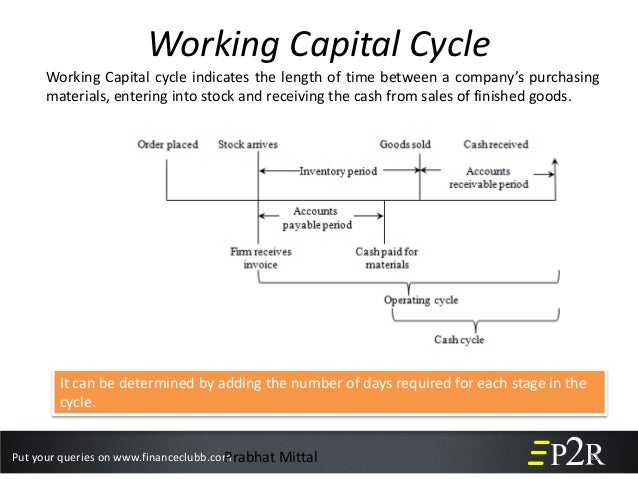

In case if the cycle is long the capital gets typically stuck without earning returns in the operational period. Current assets Assets converted to cash value within a normal operating cycle Current liabilities. Positive cycle vs negative cycle. Working Capital Current Assets Current Liabilities. Inventory Days Receivable Days Payable Days. The working capital cycle formula is.

Source: in.pinterest.com

Source: in.pinterest.com

Using the example above the working capital cycle for the manufacturer is 26 days. Or you can even say it as Working Capital Cycle Formula APP ACP PPP Or you can even calculate it as Working Capital Cycle Calculation. In other words the term operating cycle refers to the length of time which begins with the acquisition of raw materials of a firm and ends with the final realisation of cash from debtors. Current Assets Cash Marketable securities Accounts receivable Inventory Prepaid expenses Current Liabilities Accounts payable Accrued expenses. Positive cycle vs negative cycle.

Source: pinterest.com

Source: pinterest.com

This is calculated by dividing Current Assets by Current Liabilities. The formula that businesses use to calculate working capital is as follows working capital current assets current liabilities on the other hand to calculate working capital requirement businesses have to follow the below-mentioned formula net working capital requirement inventory accounts receivable accounts payable the formula of. Working Capital Cycle Formula Average Payable Period Average Collection Period Payables Payment Period. Working capital Working Capital Current Assets - Current Liabilities Cash conversion cycle. The working capital cycle formula is.

Source: in.pinterest.com

Source: in.pinterest.com

For example a manufacturing business will have more phases than a retailer. This is calculated by dividing Current Assets by Current Liabilities. A ratio above 1 means current assets exceed liabilities and generally the higher. Let us see how to calculate working capital cycle of a company from the above-mentioned formula. Lets put them into the formula.

Source: in.pinterest.com

Source: in.pinterest.com

The cash operating cycle also known as the working capital cycle or the cash conversion cycle is the number of days between paying suppliers and receiving cash from sales. In the manufacturing sector inventory days has three components. Accounts Receivable Inventory Accounts Payable Other. The cash operating cycle also known as the working capital cycle or the cash conversion cycle is the number of days between paying suppliers and receiving cash from sales. What makes a liability current is that it is due within a year.

Source: pinterest.com

Source: pinterest.com

Working Capital Formula Working Capital formula is defined under. Your inventory days arent necessarily just the. Working capital is calculated by using the current ratio which is current assets divided by current liabilities. Working Capital Current Assets Current Liabilities. Let us see how to calculate working capital cycle of a company from the above-mentioned formula.

Source: in.pinterest.com

Source: in.pinterest.com

Working Capital Current Assets Current Liabilities where. A ratio above 1 means current assets exceed liabilities and generally the higher. In other words the term operating cycle refers to the length of time which begins with the acquisition of raw materials of a firm and ends with the final realisation of cash from debtors. Using the example above the working capital cycle for the manufacturer is 26 days. Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

Source: pinterest.com

Source: pinterest.com

Working Capital Cycle formula For most businesses the Working Capital Cycle formula is as follows. Positive cycle vs negative cycle. Using the example above the working capital cycle for the manufacturer is 26 days. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling and managing cash flow. If the value of ration is lower than 1 then it indicates the negative value of it.

Source: in.pinterest.com

Source: in.pinterest.com

Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Working capital currently available assets current Liabilities The ratio is a sign of whether a firm has sufficient short-term assets to fulfil the short-term debt possessed on them. The formula for Working Capital is as follows. The continuing flow from cash to suppliers to inventory to accounts receivable and back into cash is called the working capital cycle or operating cycle. Working Capital Formula Working Capital formula is defined under.

Source: pinterest.com

Source: pinterest.com

The formula that businesses use to calculate working capital is as follows working capital current assets current liabilities on the other hand to calculate working capital requirement businesses have to follow the below-mentioned formula net working capital requirement inventory accounts receivable accounts payable the formula of. Working capital currently available assets current Liabilities The ratio is a sign of whether a firm has sufficient short-term assets to fulfil the short-term debt possessed on them. For example a manufacturing business will have more phases than a retailer. The working capital cycle formula is. Your inventory days arent necessarily just the.

Source: in.pinterest.com

Source: in.pinterest.com

Working Capital Cycle formula For most businesses the Working Capital Cycle formula is as follows. Inventory Days Receivable Days Payable Days. The higher the number of days the longer it takes for that company to convert to revenue. The formula that businesses use to calculate working capital is as follows working capital current assets current liabilities on the other hand to calculate working capital requirement businesses have to follow the below-mentioned formula net working capital requirement inventory accounts receivable accounts payable the formula of. Working Capital Formula Working Capital formula is defined under.

Source: pinterest.com

Source: pinterest.com

Working Capital Cycle formula For most businesses the Working Capital Cycle formula is as follows. The formula that businesses use to calculate working capital is as follows working capital current assets current liabilities on the other hand to calculate working capital requirement businesses have to follow the below-mentioned formula net working capital requirement inventory accounts receivable accounts payable the formula of. Current Assets Cash Marketable securities Accounts receivable Inventory Prepaid expenses Current Liabilities Accounts payable Accrued expenses. In the manufacturing sector inventory days has three components. The higher the number of days the longer it takes for that company to convert to revenue.

Source: pinterest.com

Source: pinterest.com

The working capital cycle formula is. What makes a liability current is that it is due within a year. The cash operating cycle also known as the working capital cycle or the cash conversion cycle is the number of days between paying suppliers and receiving cash from sales. I raw materials days. Positive cycle vs negative cycle.

Source: cz.pinterest.com

Source: cz.pinterest.com

Working Capital Formula Working Capital formula is defined under. The formula for Working Capital is as follows. The continuing flow from cash to suppliers to inventory to accounts receivable and back into cash is called the working capital cycle or operating cycle. Working capital currently available assets current Liabilities The ratio is a sign of whether a firm has sufficient short-term assets to fulfil the short-term debt possessed on them. In the manufacturing sector inventory days has three components.

Source: pinterest.com

Source: pinterest.com

The working capital cycle formula is. The higher the number of days the longer it takes for that company to convert to revenue. Working capital is calculated by using the current ratio which is current assets divided by current liabilities. Inventory Days Receivable Days Payable Days. Your inventory days arent necessarily just the.

Source: br.pinterest.com

Source: br.pinterest.com

In case if the cycle is long the capital gets typically stuck without earning returns in the operational period. The working capital cycle formula is. The cash operating cycle also known as the working capital cycle or the cash conversion cycle is the number of days between paying suppliers and receiving cash from sales. In other words the term operating cycle refers to the length of time which begins with the acquisition of raw materials of a firm and ends with the final realisation of cash from debtors. This number is how many days the business is out of pocket before receiving full payment and is whats known as a positive cycle.

Source: in.pinterest.com

Source: in.pinterest.com

What makes a liability current is that it is due within a year. Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue. Inventory Days Receivable Days Payable Days. The formula that businesses use to calculate working capital is as follows working capital current assets current liabilities on the other hand to calculate working capital requirement businesses have to follow the below-mentioned formula net working capital requirement inventory accounts receivable accounts payable the formula of. Working capital is calculated by using the current ratio which is current assets divided by current liabilities.

Source: pinterest.com

Source: pinterest.com

Working Capital Current Assets Current Liabilities where. A company having a working capital ratio of less than 1 may not be good as it indicates poor cash flow of the company. Or you can even say it as Working Capital Cycle Formula APP ACP PPP Or you can even calculate it as Working Capital Cycle Calculation. Your inventory days arent necessarily just the. A ratio above 1 means current assets exceed liabilities and generally the higher.

Source: in.pinterest.com

Source: in.pinterest.com

56 Inventory Days 30 Receivable Days 60 Payable Days 26 days working capital cycle. Current Assets Cash Marketable securities Accounts receivable Inventory Prepaid expenses Current Liabilities Accounts payable Accrued expenses. Working capital is calculated by using the current ratio which is current assets divided by current liabilities. The continuing flow from cash to suppliers to inventory to accounts receivable and back into cash is called the working capital cycle or operating cycle. This is calculated by dividing Current Assets by Current Liabilities.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title working capital cycle formulas by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.