Your Work related travel expenses images are available in this site. Work related travel expenses are a topic that is being searched for and liked by netizens today. You can Find and Download the Work related travel expenses files here. Download all royalty-free images.

If you’re searching for work related travel expenses pictures information linked to the work related travel expenses keyword, you have pay a visit to the ideal site. Our site frequently provides you with hints for downloading the maximum quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

Work Related Travel Expenses. If you use a road vehicle designed to carry a load of one tonne or more or nine or more passengers use a motor cycles incur bridgeroad tolls parking car hire fees meal expenses or accommodation expenses whilst away overnight for work then you have incurred travel. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. Between two separate places of employment when you have a second job providing one of those places is not your home from your normal workplace or your home to an alternative workplace that is not a regular workplace for example a. How much can you claim for work related travel.

Work Related Travel Tax Deductions Advivo Accountants Advisors From advivo.com.au

Work Related Travel Tax Deductions Advivo Accountants Advisors From advivo.com.au

You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. If you have to travel for your work you may be able to claim tax relief on the cost or money youve spent on food or overnight expenses. You can claim a flat rate of 72c per kilometre for every business kilometre you cover previously 68c per kilometre before 30 June 2020. You cannot claim for travelling to and from work unless. Travel expenses are expenditures that an employee makes while traveling on company business. Common travel expenses you may be able to claim include air bus train taxi fares.

What miles are deductible.

If you use a road vehicle designed to carry a load of one tonne or more or nine or more passengers use a motor cycles incur bridgeroad tolls parking car hire fees meal expenses or accommodation expenses whilst away overnight for work then you have incurred travel. Automate your allowable expenses save time and money. A maximum of 5000 km can be claimed each year per car with diary evidence to show how the rate per km was worked out. Work-related travel expenses also include the cost of trips. If they have to carry bulky goods or equipment back and forth to work that cannot be left at the workplace Use a. How much can you claim for work related travel.

Source: afsbendigo.com.au

Source: afsbendigo.com.au

If youre self-employed you can deduct travel expenses on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship or if youre a farmer on Schedule F Form 1040 Profit or Loss From Farming. Between two separate places of employment when you have a second job providing one of those places is not your home from your normal workplace or your home to an alternative workplace that is not a regular workplace for example a. Flug Zug Mietwaren und Hotel in nur 60s buchen. Automate your allowable expenses save time and money. Ad Trusted by thousands of companies.

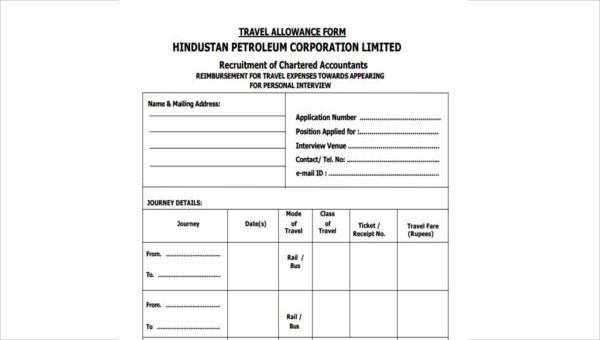

Source: sampleforms.com

Source: sampleforms.com

Work-related travel expenses is an umbrella term used to identify any expenditure that incurs due to transport travel purchases or accommodation because of your job requirements. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. Company business can include conferences exhibitions business meetings client and customer meetings job fairs training sessions and sales calls for example. Mehr Effizient durch moderne Tools. How to claim travel deductions boost your tax refund.

Source: advivo.com.au

Source: advivo.com.au

Between two separate places of employment when you have a second job providing one of those places is not your home from your normal workplace or your home to an alternative workplace that is not a regular workplace for example a. Mehr Effizient durch moderne Tools. If you travel with your partner friends or family you cant claim any travel or. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. For example if you have to travel as part of your job any expenditure could potentially be considered your work-related travel expenses.

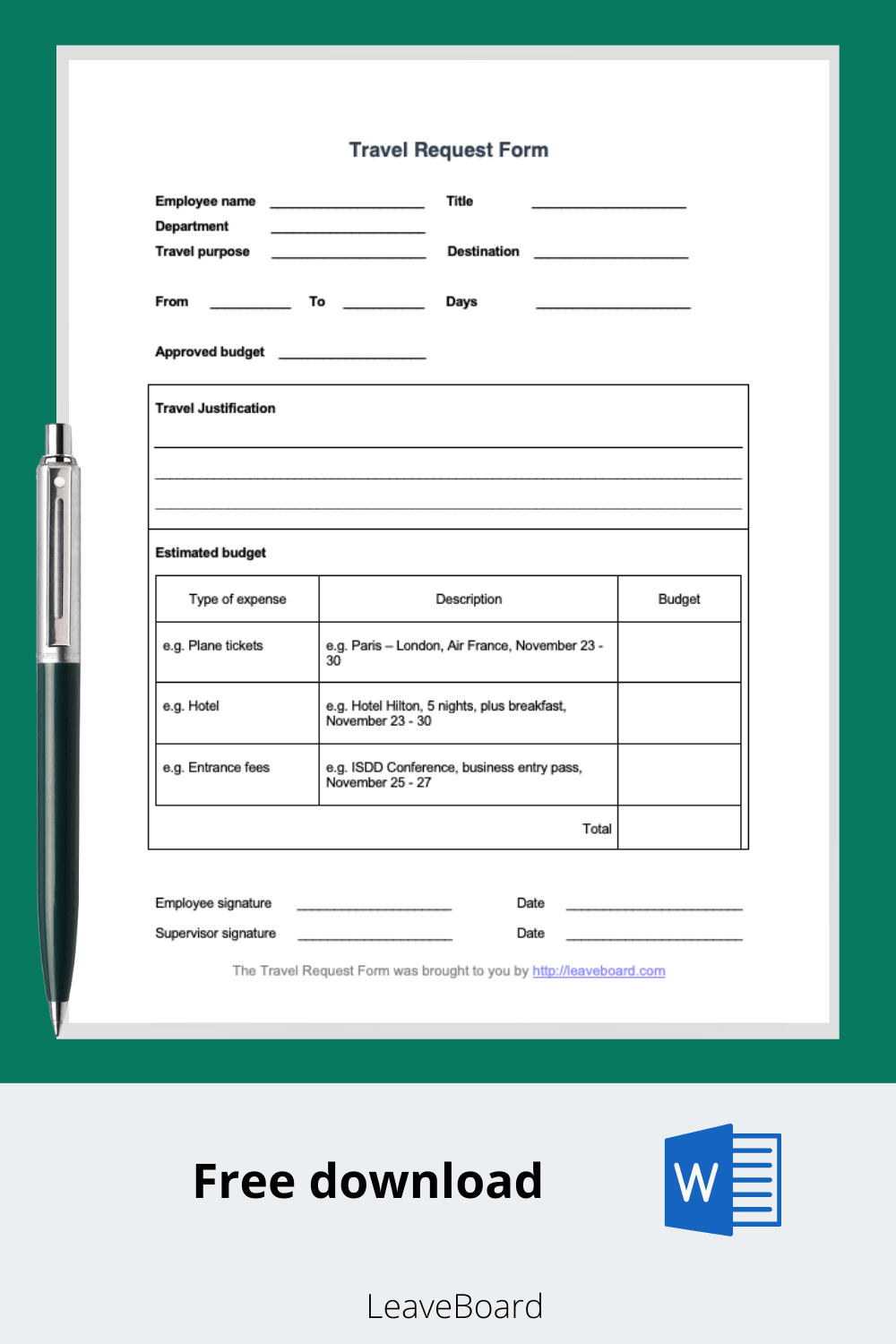

Source: leaveboard.com

Source: leaveboard.com

So really anything you spend for work can be claimed back up to 300 without having to show any receipts. Travel expenses are expenditures that an employee makes while traveling on company business. Mehr Effizient durch moderne Tools. You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. Ad Alle Kosten und Prozess voll im Block.

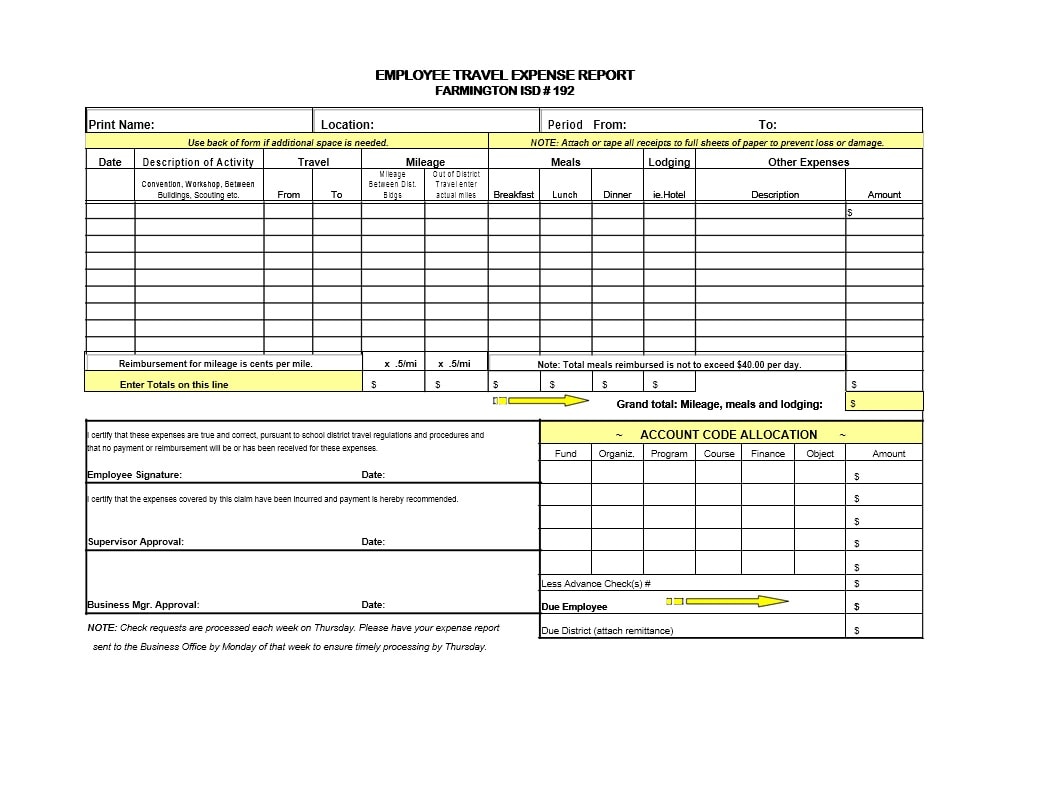

Source: templatearchive.com

Source: templatearchive.com

You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. Between two separate places of employment when you have a second job providing one of those places is not your home from your normal workplace or your home to an alternative workplace that is not a regular workplace for example a. Ad Alle Kosten und Prozess voll im Block. Automate your allowable expenses save time and money. How to claim travel deductions boost your tax refund.

Source: markspaneth.com

Source: markspaneth.com

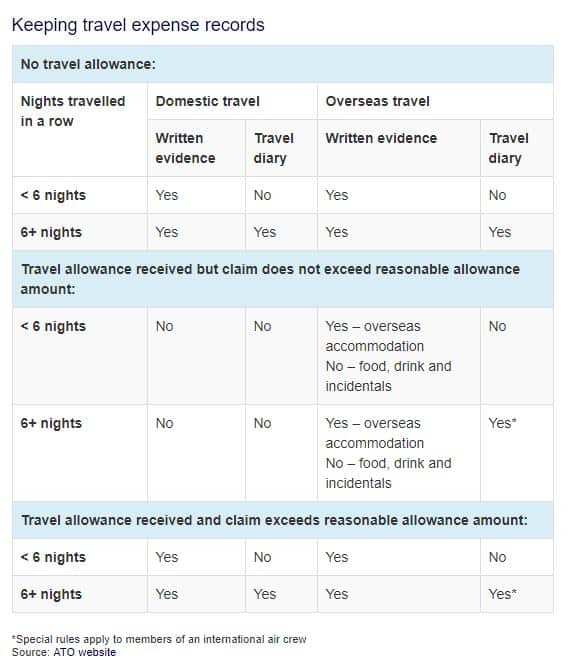

Flug Zug Mietwaren und Hotel in nur 60s buchen. Ad Alle Kosten und Prozess voll im Block. Take control of company spending with the prepaid Mastercard that does your expenses. Travel expense deductions travel allowances and travel records can seem confusing to keep track of but simply put you cannot claim any part of a work trip that is not directly related to your work. This method is best for those making a few trips a year with the maximum claim being 3300.

Source: travelperk.com

Source: travelperk.com

How to claim travel deductions boost your tax refund. You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. Company business can include conferences exhibitions business meetings client and customer meetings job fairs training sessions and sales calls for example. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. You can claim a flat rate of 72c per kilometre for every business kilometre you cover previously 68c per kilometre before 30 June 2020.

Source: pinterest.com

Source: pinterest.com

Travel expenses are expenditures that an employee makes while traveling on company business. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. Work-related travel expenses is an umbrella term used to identify any expenditure that incurs due to transport travel purchases or accommodation because of your job requirements. If you have to travel for your work you may be able to claim tax relief on the cost or money youve spent on food or overnight expenses. If you can show that your actual expenses are more than the standard mileage rate your employer will need to pay the difference.

Source: travelperk.com

Source: travelperk.com

How much work related travel expenses can I claim. If they have to carry bulky goods or equipment back and forth to work that cannot be left at the workplace Use a. Automate your allowable expenses save time and money. How much work related travel expenses can I claim. Ad Alle Kosten und Prozess voll im Block.

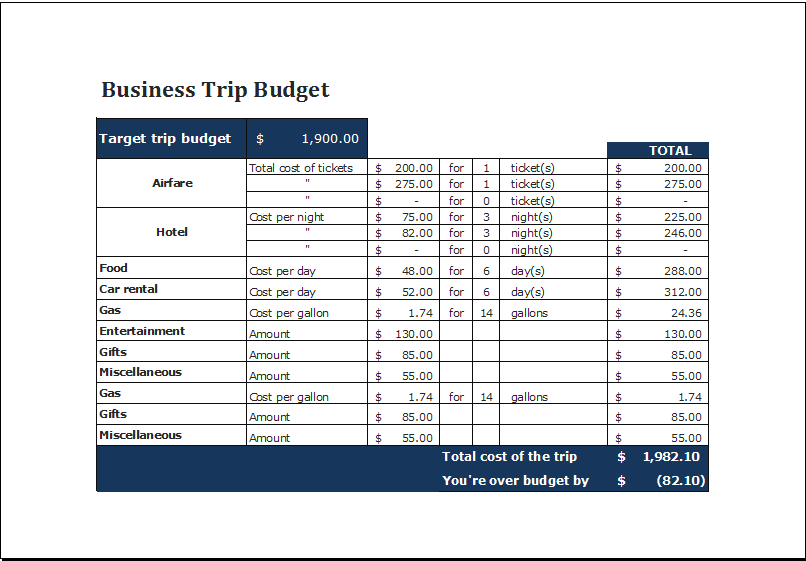

Source: xltemplates.org

Source: xltemplates.org

You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. Ad Alle Kosten und Prozess voll im Block. As of January 1 2020 the standard mileage reimbursement for work-related driving is 575 cents per business mile driven. Automate your allowable expenses save time and money. Ad Trusted by thousands of companies.

Source: pinterest.com

Source: pinterest.com

As of January 1 2020 the standard mileage reimbursement for work-related driving is 575 cents per business mile driven. Flug Zug Mietwaren und Hotel in nur 60s buchen. How much can you claim for work related travel. If they have to carry bulky goods or equipment back and forth to work that cannot be left at the workplace Use a. Common travel expenses you may be able to claim include air bus train taxi fares.

Source: free-power-point-templates.com

Source: free-power-point-templates.com

Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. Take control of company spending with the prepaid Mastercard that does your expenses. Work-related travel expenses is an umbrella term used to identify any expenditure that incurs due to transport travel purchases or accommodation because of your job requirements. Take control of company spending with the prepaid Mastercard that does your expenses. Ad Alle Kosten und Prozess voll im Block.

Source: pinterest.com

Source: pinterest.com

If you use a road vehicle designed to carry a load of one tonne or more or nine or more passengers use a motor cycles incur bridgeroad tolls parking car hire fees meal expenses or accommodation expenses whilst away overnight for work then you have incurred travel. If you can show that your actual expenses are more than the standard mileage rate your employer will need to pay the difference. What miles are deductible. Youll need to keep a diary of all work-related journeys so you can work out how many kilometres youve travelled for work. Ad Trusted by thousands of companies.

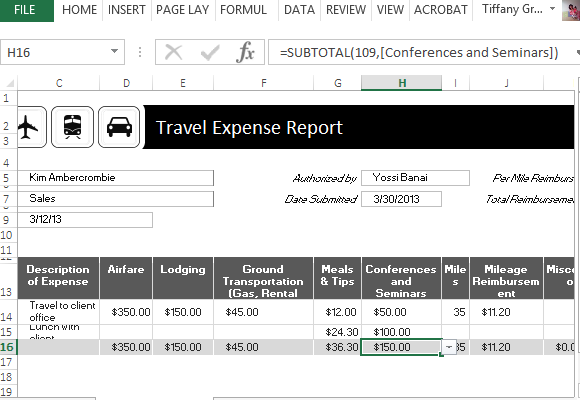

Source: vertex42.com

Source: vertex42.com

Is a travel allowance deductible. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. Ad Alle Kosten und Prozess voll im Block. Work-related travel expenses also include the cost of trips. How much work related travel expenses can I claim.

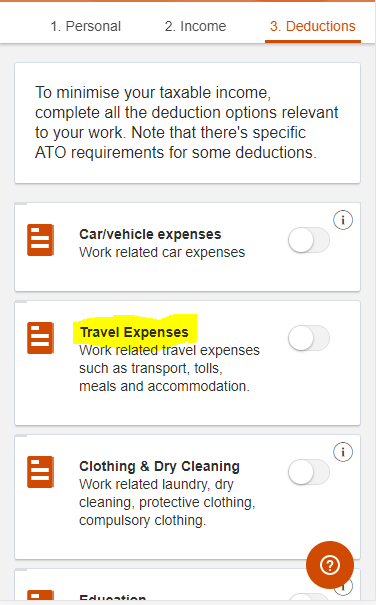

Source: help.airtax.com.au

Source: help.airtax.com.au

If you travel with your partner friends or family you cant claim any travel or. For example if you have to travel as part of your job any expenditure could potentially be considered your work-related travel expenses. Common travel expenses you may be able to claim include air bus train taxi fares. You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. Flug Zug Mietwaren und Hotel in nur 60s buchen.

Source: pinterest.com

Source: pinterest.com

Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year or less. As of January 1 2020 the standard mileage reimbursement for work-related driving is 575 cents per business mile driven. A maximum of 5000 km can be claimed each year per car with diary evidence to show how the rate per km was worked out. Take control of company spending with the prepaid Mastercard that does your expenses. So really anything you spend for work can be claimed back up to 300 without having to show any receipts.

Source: agilisca.com.au

Source: agilisca.com.au

Take control of company spending with the prepaid Mastercard that does your expenses. The primary purpose of your trip must be work related to claim it on your tax return. Ad Alle Kosten und Prozess voll im Block. So really anything you spend for work can be claimed back up to 300 without having to show any receipts. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books.

Source: pinterest.com

Source: pinterest.com

How to claim travel deductions boost your tax refund. Work-related travel expenses is an umbrella term used to identify any expenditure that incurs due to transport travel purchases or accommodation because of your job requirements. Take control of company spending with the prepaid Mastercard that does your expenses. Is a travel allowance deductible. How much can you claim for work related travel.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title work related travel expenses by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.