Your How calls and puts work images are ready in this website. How calls and puts work are a topic that is being searched for and liked by netizens now. You can Get the How calls and puts work files here. Download all free vectors.

If you’re searching for how calls and puts work pictures information related to the how calls and puts work keyword, you have pay a visit to the right site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

How Calls And Puts Work. AN INTRODUCTION INTO OPTIONS TRADING. Everything you need to know about investing and managing your portfolio. You pay me a fee for the right to call the stock away from me. A put option is bought if the trader expects the price of the underlying asset to fall within a certain time frame.

Summarizing Call Put Options Varsity By Zerodha From zerodha.com

Summarizing Call Put Options Varsity By Zerodha From zerodha.com

Puts and calls can also be. Call options are contracts to buy. AN INTRODUCTION INTO OPTIONS TRADING. A call is the right to buy a stock for a given price within a given period of time while a put is the right to sell a stock for a given price within a. The first twothe short call and putare known as naked strategies because youre exposed without a hedge protection in case something goes awry. If a stock is trading at 60 per share you may predict that the price will rise in the near future.

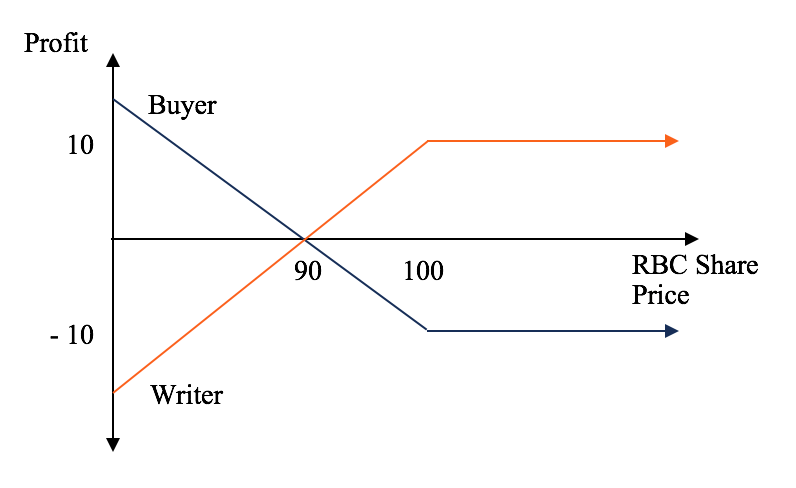

For each call and put option there is a buyer and a seller sometimes referred to as the option writer.

One party the buyer of the call has the right but not an obligation to buy the stock at the strike price by the future date while the other party the seller of the call has the obligation to sell the stock to the buyer at the strike price if the buyer exercises the option. How Call Options Work. Like a put you can choose not to exercises it. Calls have intrinsic value if the stock is trading above the strike price. Harris 2021 February 1 How do cal. 0000 - How do calls and puts work0038 - What is a call and put for dummies0108 - Are calls or puts betterLaura S.

Source: fidelity.com

Source: fidelity.com

The same idea only in the other direction. Calls have intrinsic value if the stock is trading above the strike price. If a stock is trading at 60 per share you may predict that the price will rise in the near future. Like a put you can choose not to exercises it. You pay me a fee for the right to call the stock away from me.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Unlike the simple purchase of stocks bonds or ETFs you can use puts and calls to construct option strategies that have the potential to benefit from any market scenario. The option seller earns a premium for selling. Put options are traded on various underlying assets including stocks currencies bonds commodities futures and indexes. The same idea only in the other direction. Think of a call option as a.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

They are exactly opposite of Put options which give you the right to sell in the future. How Call Options Work. Since Robinhood Financial doesnt allow naked option selling. While you could purchase 100 shares by paying. How Call Options Work.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Bull markets bear markets or even a sideways market. Very simply a call is the right to buy a put is the right to sell. If you dont do this you can end up taking losses. Think of a call option as a. Like a put you can choose not to exercises it.

Source: cmegroup.com

Source: cmegroup.com

A call is the right to buy a stock for a given price within a given period of time while a put is the right to sell a stock for a given price within a. A call option gives the holder the right to buy a stock and a put option gives the holder the right to sell a stock. The opposite of a call option where investors place an order to sell their shares at a certain price within a certain time frame. You pay me a fee for the right to call the stock away from me. One party the buyer of the call has the right but not an obligation to buy the stock at the strike price by the future date while the other party the seller of the call has the obligation to sell the stock to the buyer at the strike price if the buyer exercises the option.

Source: pinterest.com

Source: pinterest.com

Calls have intrinsic value if the stock is trading above the strike price. Very simply a call is the right to buy a put is the right to sell. You must study and practice to be successful at it. How Call Options Work. Everything you need to know about investing and managing your portfolio.

Source: investopedia.com

Source: investopedia.com

How call and put options workIf a how call and put options work stock is trading at 60 per share you may predict that the price will rise in the near future A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. A call is the right to buy a stock for a given price within a given period of time while a put is the right to sell a stock for a given price within a. One party the buyer of the call has the right but not an obligation to buy the stock at the strike price by the future date while the other party the seller of the call has the obligation to sell the stock to the buyer at the strike price if the buyer exercises the option. In todays blog post were going to be breaking down the basics of what a stock option is so you. Options are contracts or agreements between two parties.

Source: samco.in

Source: samco.in

Put options are traded on various underlying assets including stocks currencies bonds commodities futures and indexes. Bill Poulos and Profits Run Present. The same idea only in the other direction. HOW DO CALLS AND PUTS WORK. The option seller earns a premium for selling.

Source: brilliant.org

Source: brilliant.org

Call options are contracts to buy. While you could purchase 100 shares by paying. For each call and put option there is a buyer and a seller sometimes referred to as the option writer. Unlike the simple purchase of stocks bonds or ETFs you can use puts and calls to construct option strategies that have the potential to benefit from any market scenario. Both types of options of course come with two parameters.

Source: in.pinterest.com

Source: in.pinterest.com

How To Trade Options. You pay me a fee for the right to call the stock away from me. They are exactly opposite of Put options which give you the right to sell in the future. Call options are contracts to buy. Bill Poulos and Profits Run Present.

Source: youtube.com

Source: youtube.com

They are exactly opposite of Put options which give you the right to sell in the future. AN INTRODUCTION INTO OPTIONS TRADING. Call options are contracts to buy. If a stock is trading at 60 per share you may predict that the price will rise in the near future. A call option is a contract to buy a stock at a set price and within a limited time.

Source: fidelity.com

Source: fidelity.com

The contract sets a. Call options are those contracts that give the buyer the right but not the obligation to buy the underlying shares or index in the futures. Since Robinhood Financial doesnt allow naked option selling. The first twothe short call and putare known as naked strategies because youre exposed without a hedge protection in case something goes awry. The same idea only in the other direction.

Source: money.stackexchange.com

Source: money.stackexchange.com

Puts and calls can also be. Think of a call option as a. A put option is bought if the trader expects the price of the underlying asset to fall within a certain time frame. The same idea only in the other direction. 0000 - How do calls and puts work0038 - What is a call and put for dummies0108 - Are calls or puts betterLaura S.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The opposite of a call option where investors place an order to sell their shares at a certain price within a certain time frame. Calls PutsCall options put options are explained simply in this entertaining and informative 8. Put and call options explained means buying call option and put option contracts are a great way to make money in the stock market. The option seller earns a premium for selling. If a stock is trading at 60 per share you may predict that the price will rise in the near future.

Source: kotaksecurities.com

Source: kotaksecurities.com

The first is a. You must study and practice to be successful at it. Everything you need to know about investing and managing your portfolio. Options are contracts or agreements between two parties. Call options are those contracts that give the buyer the right but not the obligation to buy the underlying shares or index in the futures.

Source: investopedia.com

Source: investopedia.com

The first is a. How call and put options workIf a how call and put options work stock is trading at 60 per share you may predict that the price will rise in the near future A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. They are exactly opposite of Put options which give you the right to sell in the future. A put option can be. Like a put you can choose not to exercises it.

Source: youtube.com

Source: youtube.com

You must study and practice to be successful at it. The same idea only in the other direction. How To Trade Options. Like a put you can choose not to exercises it. A call option is a contract to buy a stock at a set price and within a limited time.

Source: investopedia.com

Source: investopedia.com

The first is a. You must study and practice to be successful at it. How call and put options workIf a how call and put options work stock is trading at 60 per share you may predict that the price will rise in the near future A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Bull markets bear markets or even a sideways market. A put option can be.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how calls and puts work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.